When you hear the word trustee, the most common image that comes to mind is that of a suited elderly gentleman with mysterious job responsibilities. So, who is a trustee? Do I Need a Trustee and Who Should I Choose?

It is a body to take care of your assets with daily management-related tasks. A trustee can be an individual, institution, or a combination of both.

Typically, a grantor can name themselves as a trustee for their revocable trusts. But once they become incapacitated or die, they need a successor trustee to take the responsibilities and handle trust management. But if you have an irrevocable trust, you can’t name yourself as a trustee and hand over the reins to an individual or institution. Both the trustees share some level of responsibilities and job tasks.

Did you miss part 1 of this series? Click here to watch now

Did you miss part 2 of this series? Click here to watch now

Do I Need a Trustee and Who Should I Choose

What Does a Trustee Do?

Generally, a trustee is someone who manages the assets, owned by a trust, in a way that benefits the beneficiaries. The exact job responsibilities can vary as per the agreement’s terms and the type of assets the trust owns. For instance, if the trust is an investor, the trustee will oversee the fiscal profits through investments in stock markets and other accounts. If the trust owns the property, then the trustee will be responsible for managing properties, deal with tenants, repairs, and other property insurance.

Depending on your state laws, a trustee may hire staff to deal with other work responsibilities and help with management functions. Investment advisers, accountants, bankers, and property consultants can be of great help. But when hiring staff, you should look for the beneficiary’s consent to avoid conflict of interest.

Traits to Look for In a Trustee

Choosing a trustee is a huge responsibility and a difficult decision to make. Depending on the type of your trust, he will be in charge of carrying out various asset management activities, and thus the responsibility shouldn’t be taken lightly.

People most often choose their spouse, children, or friends as successor trustees, but it can also lead to conflicts. Therefore, you may need a lawyer, accountant, or professional, corporate trustee to make those important decisions. Here are a few common traits you should look for in a trustee:

- A trustee should be trustworthy. If you can’t trust someone with a $100 bill, then you definitely consider him to run your trust with honesty.

- When choosing an individual, especially a friend or family member, make sure he is financially sound and intelligent. He should have a clear understanding of basic investments and asset management.

- If you’ve chosen a reliable family member who’s not financially smart, then they should’ve common decision-making skills. For example, they should be smart enough to hire the right adviser or consultant to help with key asset management roles.

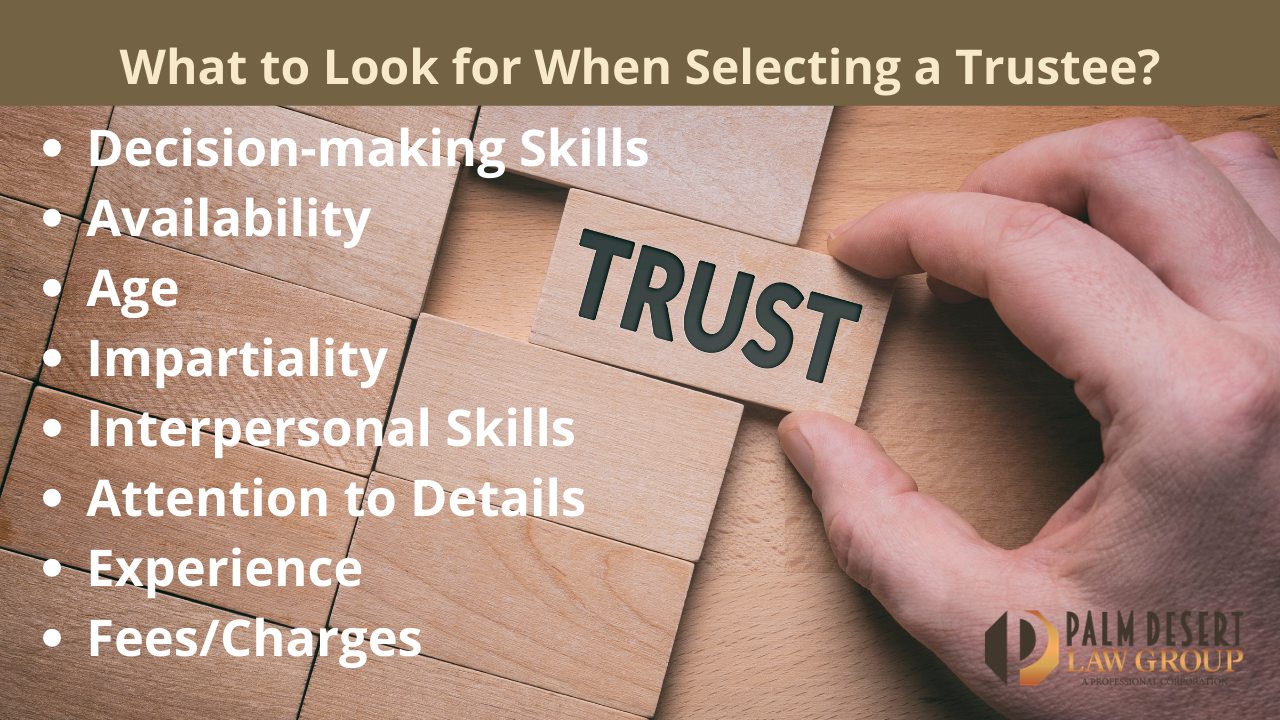

What to Look for When Selecting a Trustee?

Here are some of the key characteristics you should look for when choosing an individual or institution as a trustee:

Decision-making Skills:

When choosing someone to make decisions on your behalf, make sure he shares the same level of interest, values, faith, and spending habits. He should also have some level of concern and trepidations for the beneficiaries as you have. Additionally, he should be astute enough to make all financial decisions, including investment and asset management. He should also have an eye for hiring and recruiting the right talent to help with work responsibilities.

Availability:

When selecting a candidate as a trustee, make sure he is available for the work responsibilities. Does he have the time, and will he be available when needed? Family responsibilities and the demand for their jobs may leave them with little or no time for trust management.

Age:

Typically, a grantor is inclined to hire their friends as successor trustees. It is due to the fact; they have shared interest, values and may have gained the same level of experience and wisdom. But they may not live long enough to fulfill the responsibilities of a trustee. Therefore, age is one of the most definitive factors when it comes to selecting one for a longer duration.

Impartiality:

It is vital for your successor trustee to be impartial in his decisions and among the interests of several beneficiaries. However, it is quite difficult for a trustee to maintain the level of impartiality if he is one of the several beneficiaries or linked to one.

As a grantor, if you think that conflict might occur, then you should go for a corporate or a board of trustees to maintain the level of fairness and neutrality.

Interpersonal Skills:

A suitable trustee will be able to work efficiently under pressure. He must possess the skills required to navigate through challenging situations without deterring his self-confidence. Having strong interpersonal skills is one of the most compelling traits of a trustee. One that gets intimidated with challenging situations or is overbearing with his decisions may lead to strained relations with the beneficiaries.

Attention to Details:

Trustees have important responsibilities to fulfill and are accountable as a fiduciary for their decisions and actions. A trustee who maintains a record of his action is less likely to face conflict and challenges for his decisions.

Experience:

It is not necessary for a trustee to have relevant experience, but he should have the skills and knowledge to carry out the responsibilities. Some who doesn’t know the basic of finance or investment can’t be the best option; however, he should be willing to upskill and engage in professional growth. Secondly, he can also consult relevant persons for trust and asset management.

Fees/Charges:

Typically, trustees who are friends or family members don’t charge a fee for their services, out of respect for the grantor. They may consider it as a family obligation and thus provide free of cost services. However, if you need a full-time or long-term trustee, it’s ideal to pay a fee for their efforts to show reverence for their time and work responsibilities. You can keep track of their activities, work responsibilities, and expenses to substantiate a reasonable fee.

There is no denying; a reliable trustee is important to manage your trust after your demise. Our guide will help you in selecting one who is responsible and trustworthy enough to carry out the job role.

W hope this has answered the question of "Do I Need a Trustee and Who Should I Choose "

We offer a complete spectrum of legal services for business owners and can help you make the wisest choices on how to deal with your business throughout life and in the event of your death. We also offer you a LIFT Your Life And Business Planning Session, which includes a review of all the legal, insurance, financial, and tax systems you need for your business. Schedule online today.